In addition to points, different lenders may have different loan-related fees.

Lenders charge fees in association with third party services (such as appraisals, credit reports, tax service, etc.) AND they charge fees in association with their own services (processing, underwriting, closing, etc.). There is a significant amount of coordination involved with a mortgage transaction. Multiple parties provide services at variable times during the mortgage loan process.

Types of Fees

Typically, because it is the largest third party service expense incurred during processing, the lender will ask you to pay for or make a deposit on the appraisal after you have been delivered and agree to complete the loan application. The appraisal fee can vary based on the size of the home, its proximity to similar properties, or if it is in a rural location, which will involve significant travel time for the appraiser. An average property appraisal should expect a base cost of somewhere around $400-$500. Again, the lender will more than likely ask for this to be paid outside of settlement.

Some lenders may also ask for a credit report fee, which I have seen vary between $10 and $75. If you are asked to pay more than these amounts, it would be a good time to stop and understand what the additional money is for and if it is refundable if the transaction does not close.

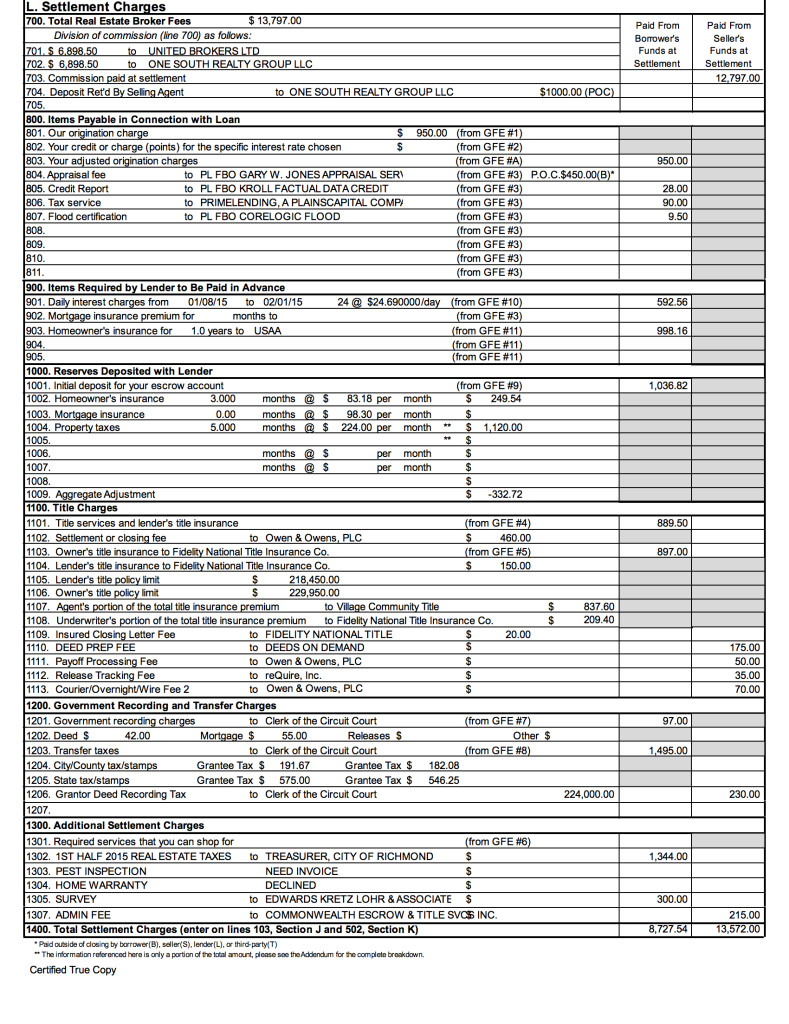

Other ‘third party fees’ are typically collected at settlement/closing. They are, but not limited to:

- settlement agent fees

- tax service fees

- wire fees

- title insurance (owners and lenders)

- recording fees

- city or county tax stamps or transfer taxes.

Some areas have different traditions based on whether the buyer or seller pays all or some of the tax or transfer tax fees. Because these fees are “passed through” to a third party, there should be very little difference in them from lender to lender.

What is ‘Lender-Related’?

You will also potentially see “lender-related fees”, which are typically referred to as “junk fees”. Please avoid the temptation to consider them as unnecessary greedy ways for lenders to capture a dollar from you. Every lender has a base costs internally to provide services such as processing, underwriting and closing to facilitate a loan. Some lenders may outsource those services and some maintain them in house.

In either case, it is a legitimate human resource expense. While there is no specific research which compiles specifically lender related fees, I suspect at the time of this blog, the cost to be close to a $1,000 per loan on average (according to 2nd Quarter 2014 MBA Quarterly Mortgage Bankers Performance Report for fulfillment personnel). Some lenders may try to pass the entire cost off to the consumer and some may only pass a portion, but either way it is a legitimate cost for the lender to do business.

Confusing? Ask Us to Explain Until You Are Comfortable

Lender-related fees can cause confusion with borrowers as it is these service related fees in which some substantial variation may come into play from lender to lender. Some lenders absorb the fees in the rate quote using “yield spread”, possibly making them slightly higher in rate but lower in closing costs. The tradeoff being “pay them now or pay them over the life of your loan”. Every customer has different motivations and sensitivities to cash to close versus payment and almost every lender can accommodate the borrower’s choice. The key again, is a talented Loan Officer who can walk you through the options. Be sure to review a “Fees Worksheet” with the Loan Officer to understand each fee and its purpose in the transaction. Be careful of the phrase “no closing cost” loan. A subject for another blog at another time, but just know that for the moment there is no such animal.